Recent Work

Explore real-world examples of our work, success stories, and the solutions we have provided to clients across various industries. These case studies offer a deeper look into how we’ve helped businesses like yours overcome challenges, achieve their goals, and drive tangible results.

A track record of

FTA expertise and delivery

Case 1

Analysis of conditions which satisfy rules of origin requirements, to avail preferential benefits in case of export of premium tea products from India to various FTA countries. The following scenarios were analysed:

- When tea is locally procured, and the packing material is imported from other countries.

- When tea is imported from other countries and blended and packaged in India

Case 2

Creation of Optimal Business Model for sourcing and supply strategy.

- Existing Model: Indian entity has been supplying the final products to USMCA countries i.e. USA, Mexico and Canada.

- Proposed Model: A manufacturing unit will be set up in Mexico wherein final products will be manufactured from raw materials imported from India and then the same will be supplied to USMCA countries.

- In respect to this proposal, we analysed the eligibility to avail the benefit of concessional tariffs under the USMCA Agreement, as well as the rules of origin conditions which needed to be satisfied.

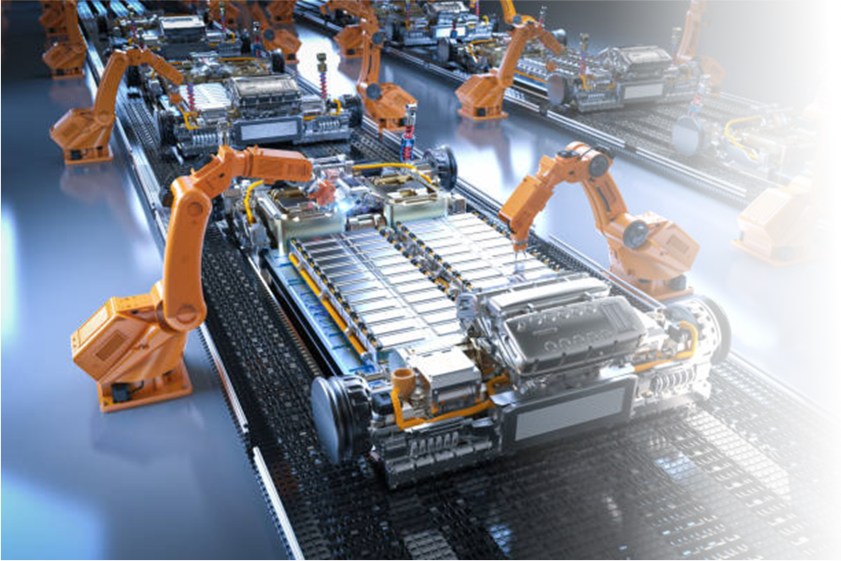

Case 3

Tariff Mapping and analysis of Rules of Origin

For a leading battery manufacturer, we analysed whether the raw materials imported, and the final products exported, were eligible for a preferential rate of duty benefit under the various free trade agreements entered into by India.

Further, we also analysed the requirements under the Rules of Origin under each of these FTAs. As a result, our client was able to optimize their supply chain structure.

Case 4

Review of contract with vendors – specific clauses relating to compliance with requirements under trade agreements.

We provided support to a power producer regarding import of solar modules from Vietnam under the Asean-India FTA. We vetted vendor agreements to ensure compliance with the rules of origin criteria under the respective Foreign Trade Agreements. Further, adding safeguards to the Agreement to protect the importer from liability in case of non-compliance on the vendor’s side.

Case 5

Compliance review.

Support was provided to a leading manufacturer and refiner of precious metal products with respect to import of gold chloride under the India-UAE & India-Japan FTA.

Work involved vetting of Certificate of Origin and other trade documentation to assess compliance with local laws/ trade agreements.

Case 6

Advance Ruling

We advised and assisted clients in drafting and filing Applications for Advance Rulings before the Customs Authority, for Advance Ruling on the eligibility to avail benefits under the various free trade agreements entered by India.

Once Rulings are issued, this brings certainty, as Customs are bound to the ruling for a specified period.

We advised and assisted a leading nutrition products manufacturer, in filing an Application before the Customs Authority for an Advance Ruling on whether their imported inputs satisfied the value addition criteria and minimal operation criteria under the India ASEAN FTA.

Case 7

Investigation support

We assist clients ( importers in India and exporters located in FTA countries ), in dealing with the suspension of FTA benefits on goods imported into India, pending verification carried out by the Indian Customs Department under the Free Trade Agreements.

The assistance being provided include

(a) Handholding during the investigation.

(b) Review of available documentation to identify any gaps, relevant to the investigation.

(c) Advising on documentation to be maintained to avoid similar adverse verification findings in future.

Support was provided to a global trading and distribution company regarding import of manganese metal into India by availing the benefit of Asean-India Free Trade Agreement.